The Only Guide to Ach Payment Solution

Cord transfers are likewise much more expensive than ACH payments. While some banks do not charge for wires, sometimes, they can cost consumers approximately $60. EFT payments (EFT represents electronic funds transfer) can be made use of mutually with ACH settlements. They both explain the same repayments mechanism.:-: Pros Expense: ACH payments often tend to be less expensive than cord transfers Rate: faster because they do not make use of a "batch" procedure Disadvantages Rate: ACH repayments can take several days to process Expense: relatively pricey resource: There are two sorts of ACH payments.

ACH credit history purchases allow you "press" cash to different banks (either your very own or to others). Below are 2 examples of exactly how they work in the wild. Several companies provide direct deposit payroll. They utilize ACH credit rating purchases to push cash to their staff members' checking account at marked pay periods.

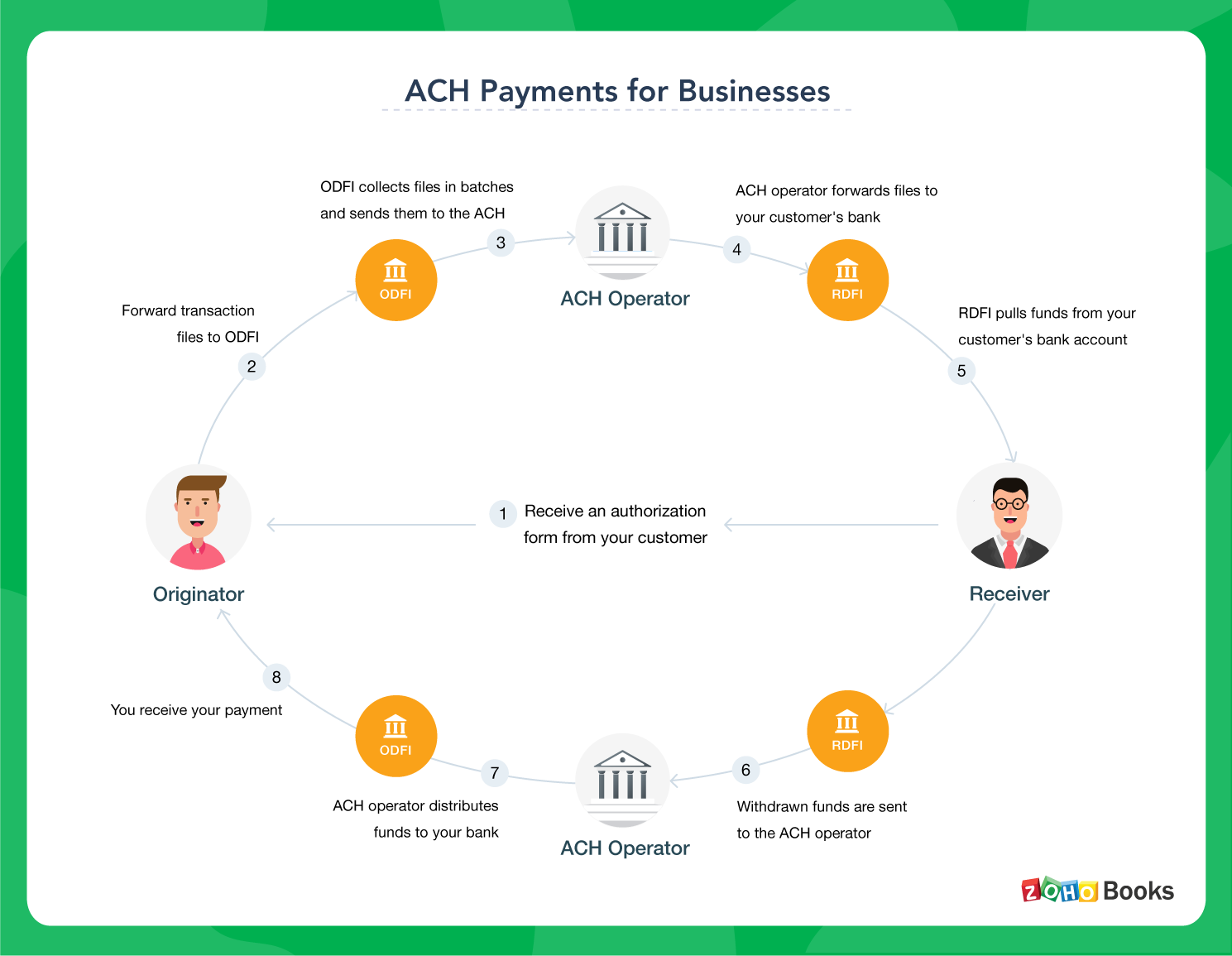

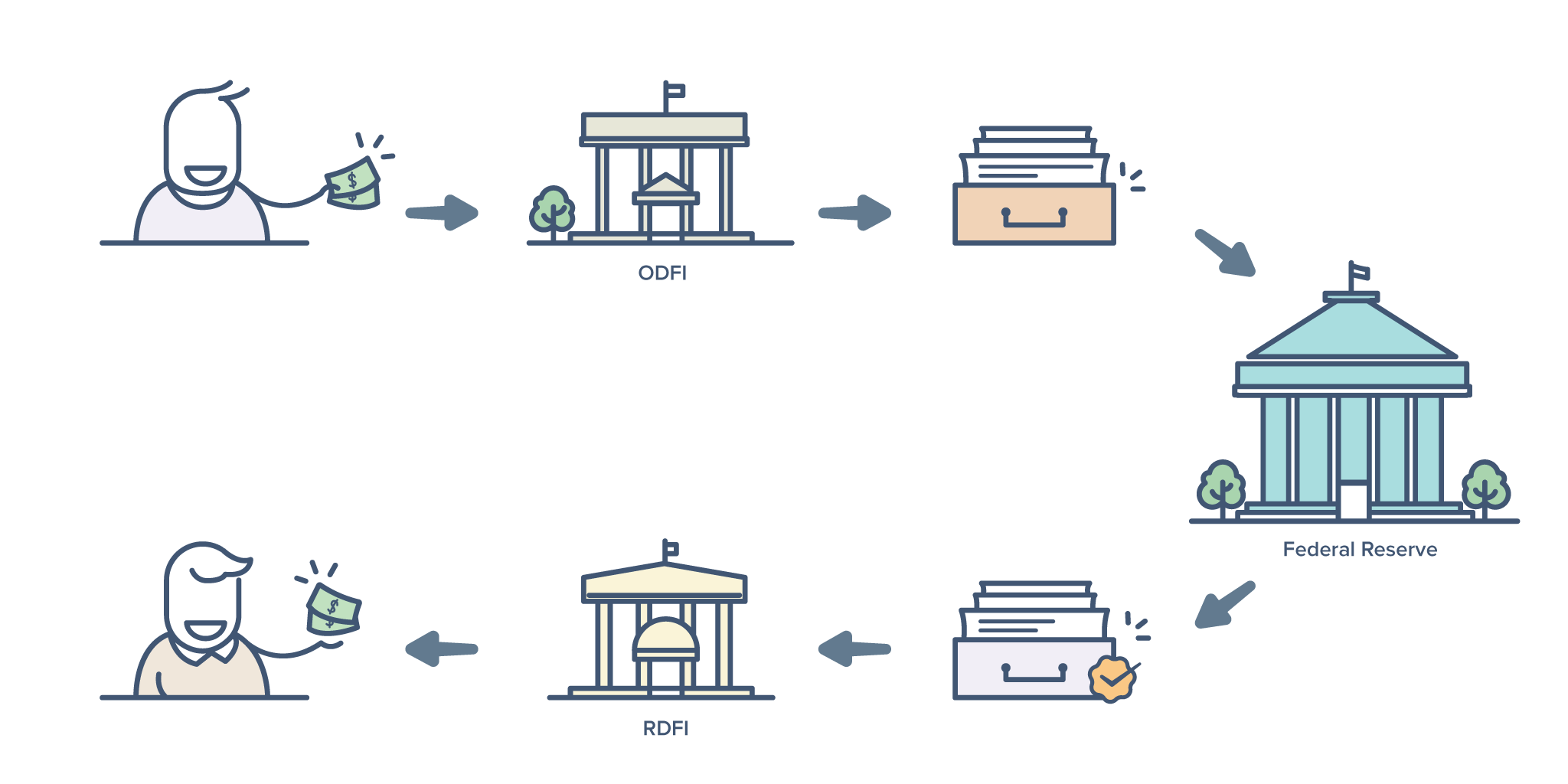

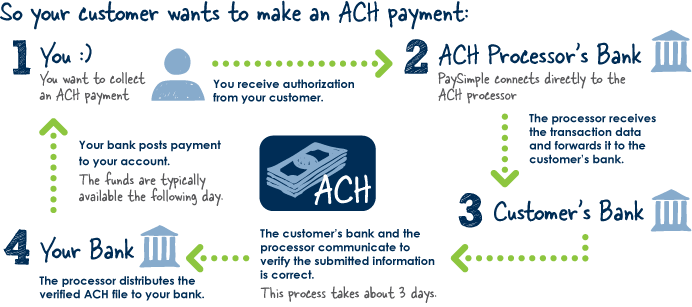

Customers that pay a business (state, their insurance service provider or home loan loan provider) at certain periods might select to enroll in persisting payments. That gives the business the capability to initiate ACH debit purchases at each payment cycle, drawing the amount owed directly from the client's account. Aside from the Automated Clearing House network (which links all the banks in the United States), there are 3 other players associated with ACH settlements: The Originating Vault Financial Establishment (ODFI) is the financial organization that starts the transaction.

Ach Payment Solution Can Be Fun For Anyone

(NACHA) is the detached governmental entity responsible for managing and also managing the ACH network. When you authorize up for autopay with your phone firm, you offer your checking account information (directing and also account number) and authorize a reoccuring payment permission.

Both banks after that communicate to guarantee that there are sufficient funds in your financial institution account to refine the purchase. If you have enough funds, the purchase is refined and also the cash is routed to your telephone company's checking account. ACH repayments commonly take several organization days (the days on which financial institutions are open) to undergo.

Per the standards established forth by NACHA, banks can choose to have ACH credit ratings refined as well as provided either within a service day or in one to 2 days. ACH debit transactions, on the other hand, need to be processed by the visit homepage following company day. After receiving the transfer, the other bank could also apprehend the transferred funds for a holding period.

The modifications (which are happening in phases) will certainly make possible widespread usage of same-day ACH repayments by March 2018. ACH payments are commonly more affordable for organizations to process than credit cards.

All about Ach Payment Solution

Some ACH cpus bill a flat rate, which usually varies from $0. 25 to $0. 75 per purchase. Others bill a flat portion charge, varying from 0. 5 percent to one percent per transaction. Providers may likewise bill an added regular monthly charge for ACH settlements, which can differ. Square makes use of ACH settlements for deposits, as well as there's more no charge connected with that for Square sellers.

These turn down codes are vital for giving the appropriate information to your clients as to why their payment didn't go through (ach payment solution). Below are the four most typical decline codes: This means the consumer didn't have enough cash in their account to cover the quantity of the debit entrance. When you obtain this code, you're most likely going to have to rerun the deal after the consumer transfers even more money into their account or gives a different repayment technique.

It's likely they neglected to alert you of the change. They need to supply you with a new financial institution account to refine the deal. This code is set off his explanation when some mix of the information given (the account number and name on the account) does not match the financial institution's records or a missing account number was gotten in.

In this instance, the client requires to supply their bank with your ACH Begetter ID to enable ACH withdrawals by your business. Rejected ACH repayments can land your business a charge fee.

Excitement About Ach Payment Solution

To prevent the headache of untangling ACH declines, it might deserve just approving ACH repayments from trusted clients. Although the ACH network is taken care of by the federal government and also NACHA, ACH repayments don't have to follow the same PCI-compliance guidelines required for bank card handling. Nevertheless, NACHA calls for that all parties involved in ACH transactions (consisting of companies starting the repayments as well as third-party processors) execute processes, procedures, and controls to protect delicate data.

That implies you can not send or obtain financial institution info through unencrypted e-mail or troubled internet types. Make sure that if you make use of a 3rd party for ACH settlement handling, it has applied systems with state-of-the-art encryption approaches. Under the NACHA policies, begetters of ACH repayments need to additionally take "commercially practical" actions to ensure the credibility of consumer identity and also directing numbers, and also to recognize possible fraudulent activity.